Property tax relief is available for flood and storm damaged property. 17 tax extension deadline SC-2022-06 IRS announces tax relief.

Optima Tax Relief Review 2022 Is It Legit Finder Com

23 and as a result affected parties will have until that February date to file returns and pay.

. Children Tax Credit. The Tax Relief Program began in 1973 as a result of the 1972 Question 3 constitutional amendment. The guidance issued today addresses unanticipated changes in expenses because of the 2019 Novel Coronavirus COVID-19 pandemic and provides that previously provided temporary relief for high deductible health plans may be applied retroactively to January 1 2020 and it also increases for inflation the 500 permitted carryover amount for.

About The Taxpayer Relief Act. Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief. Dont miss this important Oct.

How to calculate the amount you can get tax relief on. Donating land property or shares. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

The income limit for elderly and disabled is 31600. The Tax Relief Credit is a rebate and does not have to be paid back unless it is later determined that the recipient was not eligible for the program. The tax relief that landlords of residential properties get for finance costs is being restricted to the basic rate of Income Tax.

TCA 67-5-701 through 67-5-704. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by the Commonwealth to each school district. Create and file your tax return Now.

Tax cuts decrease the revenue of the government and increase the disposable income of taxpayers. Add your electricity heating and internet costs and multiply the total costs by the number of days worked at home. The Tax Relief section processes these applications and determines eligibility for the program.

Latest Updates on Coronavirus Tax Relief Penalty relief for certain 2019 and 2020 returns. PR-2022-10 September 19 2022. Property tax reduction will be through a homestead or farmstead exclusion.

The Economic Growth and Tax Relief Reconciliation Act of 2001 reduced business and investment taxes. Who Qualifies for Relief I am the spouse of a military service member living in Virginia. For instance certain deadlines falling on or after August 30.

To help struggling taxpayers affected by the COVID-19 pandemic the IRS issued Notice 2022-36 PDF which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns lateThe IRS is also taking an additional step to help those who paid these penalties already. The amount of reduction depends on the amount of value loss and when the natural disaster occurred. A tax cut represents a decrease in the amount of taxpayers money that go towards government revenue.

The tax relief postpones various tax filing and payment deadlines that occurred starting on Sept. You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses. You can easily enter your W-2.

Following the recent disaster declaration issued by the Federal Emergency Management. Yes provided you are present in Virginia solely to be with your service member spouse who is permanently stationed here in compliance with military orders and the income you received in. Wage income and earned interest.

Multiply by 30 03 For the years 2020 and 2021 the relief for internet was 30 as. Property Tax Stabilization Program. WASHINGTON The Treasury Department and the Internal Revenue Service today issued Notice 2021-25 PDF providing guidance under the Taxpayer Certainty and Disaster Relief Act of 2020.

Below is a list of the different categories and their links. For 2022 to calculate the amount of costs you can get tax relief on. Claim a tax credit if the company is loss making worth up to 145 of the surrenderable loss Research and Development Expenditure Credit This replaces the relief previously available under the.

Am I exempt from filing Virginia income tax returns under the Military Spouses Residency Relief Act. The qualifying fees must be paid for an approved course at an approved college. The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring and employing individuals from certain targeted groups who have faced significant barriers to employment.

Individuals and households affected by the water crisis that reside or have a business in Hinds county qualify for tax relief. Income Tax Credits Individual income tax credits provide a partial refund of property tax andor rent paid during the tax year. Find disaster tax relief information and resources.

Another way to analyze tax cuts. Includes Corporation Tax Capital Gains Tax Construction Industry Scheme CIS and VAT. IR-2021-79 April 8 2021.

Single or married filing jointly with or without dependents. WASHINGTON Victims of Hurricane Fiona beginning September 17 2022 now have until February 15 2023 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. You may get relief if the property is in the UK but youre not a UK resident.

The declaration permits the IRS to postpone certain tax-filing and tax-payment deadlines for taxpayers who reside or have a business in the disaster area. File schedules on your individual or joint return for small business home-based business investment properties or rental unit income. Property damaged or destroyed by something beyond the property owners control is eligible for a reduction of assessed value resulting in lower property taxes.

The Act added a temporary exception to the 50 limit on the amount that. Other charges and levies do not qualify for relief such as. The tax relief that landlords of residential properties get for finance costs will be restricted to the basic rate of Income Tax this will be phased in from April 2017.

This is being phased in from 6 April 2017 and will be fully in. Tax relief on donations Gift Aid payroll giving leaving a gift in your will keeping tax records. Each year over 100000 individuals receive benefits from this 41000000 plus program.

Businesses can temporarily deduct 100 beginning January 1 2021. Deadline to file 2019 and 2020 tax returns to get COVID penalty relief postponed in declared disaster areas IR-2022-177 IRS expanding dyed diesel penalty relief as a result of Hurricane Ian IR-2022-175 IRS. 2020 provided transition relief for employers that hired certain individuals residing in empowerment zones by extending the 28-day.

There is no income limit for disabled veterans widowers of a disabled veteran or the spouse of a soldier killed in action. The State of Maine provides a measure of property tax relief through different programs to qualified individuals. While some are applied at a local level others may be applied for through the Income Tax Division.

State Property Tax Deferral Program. From 6 April 2015 you must spend at least 90 days in an overseas property to qualify for relief for that tax year.

Four Simple Scenarios That Show How Marginal Rates And Tax Breaks Affect What People Actually Pay

Honolulu Hi Irs Tax Representation Tax Resolution Tax Help Tax Relief Services Home

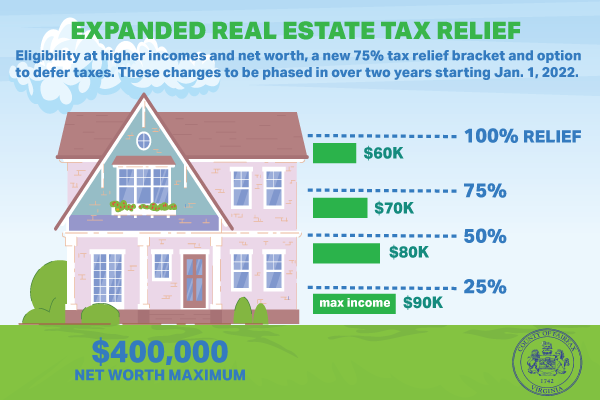

Board Of Supervisors Expands Real Estate Tax Relief Program News Center

Can You Claim A Tax Deduction For Assisted Living The Arbors

Tax Relief For Elderly Disabled York County Va

Tax Time Already 2022 Tax Deductions For Homeowners A Covid Rebate

Tax Relief And Small Business Grants Resources Official Website Assemblymember Sharon Quirk Silva Representing The 65th California Assembly District

Detroit Tax Relief Fund Dtrf Wayne Metro Community Action Agency

16 Amazing Tax Deductions For Independent Contractors Next

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

What Is Tax Relief The Kansas City Star

7 Best Tax Relief Companies 2022 Our Picks For Tax Debt Help

Tax Credits Save You More Than Deductions Here Are The Best Ones

2022 State Of Illinois Tax Rebates Scheffel Boyle

Tax Relief Blog Tax Tips News From Optima Tax Relief

Best Tax Relief Companies To Reduce Your Tax Debt Revised 2022

Sales Tax Deduction What It Is How To Take Advantage Bankrate